In a note to clients today, Goldman Sachs continues to layout the argument for why the Dollar should strengthen over the coming year, especially against other G10 currencies. GS’ main view is based on their forecast for US growth to pick up quite sharply, which is poised to make G10 growth the most US-centric in a long time.

In this regard, we found 2 important topics to emphasize and present from GS’ note. First, is the strong Dollar story so widely talked about and positioned for that the hurdle for positive growth surprises is very high? Second, where in the G10 should one express a USD-bullish view ahead of the ISM and payrolls?

1. Is the strong Dollar story so widely talked about and positioned for?

“A stronger Dollar is widely talked about, but not positioned for,” GS answers.

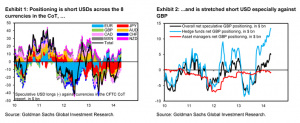

“Exhibit 1 shows FX positioning in the CFTC’s Commitment of Traders (CoT) report, with overall speculative positioning in the report short Dollars (the black line is in positive territory). Dollar shorts are notably stretched against the GBP (Exhibit 2), but are also sizeable versus the EUR and NZD. Speculative USD longs of any size exist only versus the JPY and CAD, with long Dollar positioning in both places arguably less an expression of USD bullishness and more about expectations for further monetary stimulus in Japan and a dovish BoC in Canada,” GS clarifies.

“As such, we don’t think the hurdle for US data to surprise positively is all that high,” GS argues.

2. Where in the G10 should one express a USD-bullish view ahead of the ISM and payrolls?

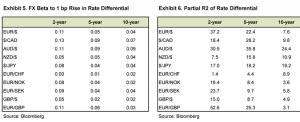

“Exhibits 5 and 6 show the results from simple variance decompositions, where Exhibit 5 shows the impact of a 1bp move in the rate differential (2-, 5- and 10-year) on key G10 crosses (in %) and Exhibit 6 gives the amount of variation (the partial R2) attributable to the rate differential. This exercise shows that US growth surprises, by way of the 2-year rate differential, have the largest impact on $/CAD (a 1bp move in the rate differential in favor of USD raises $/CAD by 0.13% on the day), followed by EUR/$, AUD/$, $/JPY and, finally, GBP/$,” GS answers.

“We emphasize that these elasticities are in no way structural. They merely reflect how the FX market has been trading over the last 60 trading days. However, we think this exercise highlights the appeal of $/CAD upside in trading the US cyclical rebound and EUR/$ downside, where the cyclical divergence from the US is arguably most pronounced,” GS adds.