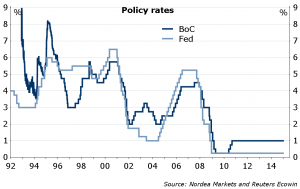

The Bank of Canada announced a surprise 25bp cut to its key interest rate Wednesday – a move it calls “insurance” against the potentially destructive effects of the oil price collapse. While the Fed and the BoC historically often have travelled in pair, we believe divergence will be the case this time. Cheaper crude oil, while good for the US economy, is unequivocally bad for Canada.

The Bank of Canada today announced that it is lowering its target for the overnight rate by 25bp to 0.75%. This decision is in response to the recent sharp drop in oil prices, which will be negative for growth and underlying inflation in Canada, the central bank said in its statement.

The central bank warned that lower oil prices would take a sizeable bite out of economic growth in 2015, delay a return to full capacity and hurt business investment – a trend that has already triggered mass layoffs and production cuts in Alberta’s oil patch. Investment in the oil and gas sector will decline by as much as 30% this year.

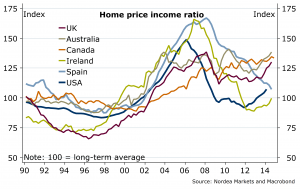

But the effects could spread further, threatening financial stability as a result of possible losses to jobs and incomes due to lower returns on energy exports, according to the central bank.

The BoC bank slashed its GDP growth forecast to 2.1% this year (from 2.4%), before rebounding to 2.4% in 2016. The worst effects of the oil collapse will be felt in the first half of this year, when the bank expects annualized growth of 1.5 per cent, nearly a full percentage point lower than its October forecast.

“The negative impact of lower oil prices will gradually be mitigated by a stronger U.S. economy, a weaker Canadian dollar, and the Bank’s monetary policy response,” the BoC said today.

The economy is expected to return to full capacity around the end of 2016, a little later than was expected in October.

The BoC’s new forecast calls for overall inflation to fall well below its 2% target this year, averaging just 0.6%. Core inflation, which excludes volatile food and energy prices, is expected to average 1.9% in 2015.

Nordea