The SNB defends the CHF floor with an interest rate of now -0.25%. If needed, a further cut and interventions are possible. The floor will not move.

Just a week ago, during the regular monetary policy meeting, the SNB didn’t feel the time was ripe for negative interest rates. Now policy makers changed their mind. Reacting to increased demand for safe investment in the wake of the Russian crisis, the SNB introduced an interest rate of -0.25% on sight deposit account balances at the central bank. Negative interest will be charged as of 22 January 2015 (coincidence or not: the date of the next ECB policy meeting) on the portion of the sight deposit account balance which exceeds a certain threshold. The target range for the three-month Libor was lowered to -0.75% to 0.25% (from 0 to 0.25%), so that the mid-point is now below zero.

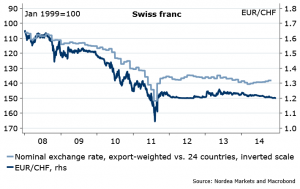

The SNB’s aim is to defend the minimum exchange rate of EURCHF 1.20. An even stronger Swiss franc would be a severe burden for the economy and could push it from price stability to deflation. The move indicates that policy makers currently worry more about capital inflows related to the Russian crisis than about ECB QE looming.

We don’t think that the deposit rate has reached the lowest possible bound. If needed, a further cut and interventions are possible. The floor will not move.

The market has reacted to the cut by bringing the CHF weaker: EURCHF hit 1.2097. The move essentially means the SNB will not have to intervene to buy EUR, but the negative rate creates incentive for private sector to do so. The CHF remains one of the most overvalued currencies in the G10 universe. We stick to our forecast of EURCHF moving toward 1.25 next year, potentially higher, as the financial outflow resumes.

Nordea