A helicopter view, 2014 and 2015. Is the turning point near? 2008 is a roadmap in terms of price action…but fundamentals better now.

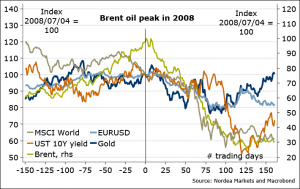

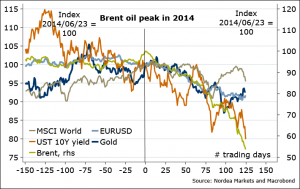

This has been the year of two halves. And to me, price action in the Markets alone does resemble 2008 somewhat. Compare and contrast.

Figure 1. Back then…

Figure 2….And now

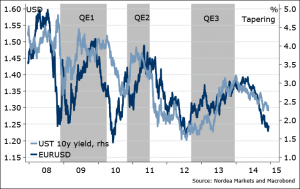

Mea culpa, I didn’t envision the timing and the extent of the USD strength this year. For what it’s worth, I tried to be consistent with the outlook we at Nordea had for global economy on rates. Better luck next year.

Consistency? As I argued in my piece on the dollar history early this year, the USD strengthening historically has been consistent with global disinflationary environments, ones of worsening growth momentum…i.e. not when Fed hikes rates. And so it was – in contrast to consensus expectations. Policy divergence? If anything, policy convergence it has been, as Fed first hike has been pushed forward (e.g. December ’15 Fed funds futures rate is down 30bps since July). I argued, too, early this year that the consensus back then, the EURUSD at 1.25 AND the 3.5% UST 10Y yield, was not both going to happen. And so it didn’t.

Figure 3. Common trend still your friend

This time is different, better, I did argue in my recent posts, data and gut would suggest to me that we are up for a better year, not worse.

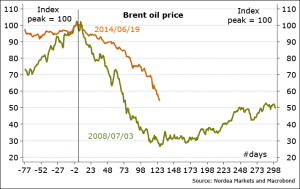

Technicals matter too. In 2008, the Brent oil price reached the lows on the Christmas Eve. Are we going to experience more of this déjà vu? In my world (read: mind), USD 62.00/62.50 per barrel is crucial, the 200 month moving average and the completion of the wedge break. Also, if 2008 is a roadmap, we should hold soon.

Figure 4. Enough is enough?

If so, we may be up for a coordinated turn – long rates, EURUSD, EM and commodity currencies…

Will commodity prices go up in 2015? Not unlikely. Partly due to the potential surprise from the euro area I wrote about last week. Partly due to other signals, including China, which I will comment on in my last Nordea’s Likely Unlikely 2015 piece, out tomorrow… (link will be here).

And the trades 2015? Yes, more specifics, as usual, in the second week of January 2015 (just as most of the November-written year ahead recommendations will have played out. :))

Nordea