We do not expect a ‘Yes’ in the referendum on gold, but such an outcome would bring the SNB action forward: we now expect the SNB to introduce a fee on franc sight deposits to take pressure off the EURCHF floor.

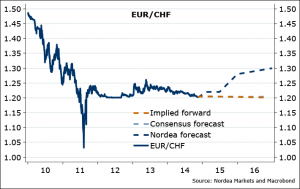

EURCHF now trades very close to the 1.20 floor, driven 1) by speculation about the outcome of the gold referendum on 30 November and 2) ECB is moving towards more quantitative stimulus (Nordea expects sovereign QE). We thus feel that words from the SNB will not be enough this time to defend the EURCHF floor at 1.20. Interventions against the CHF may happen, but given the immense size of the SNB’s balance sheet, a fee on franc deposits now looks likely to come during the coming months. In case of “yes”-outcome in the referendum – which we don’t expect – it could come immediately afterwards. The next regular occasion would be the SNB policy meeting on 11 December, a few days after the next ECB meeting.

Inflation in Switzerland is already at zero, growth is slow and stronger a CHF would weigh on the economy. Against that background, SNB policy makers have always been very firm in their defence of the CHF floor, and we think, this is credible.

The SNB has expressed worry about the 30 November referendum on SNB’s gold holdings that would force the SNB to hold 20% of assets in gold, up from 8% currently. In case of a “Yes” outcome, the SNB will need to buy gold with the reserves of which the largest share is in EURs (45% of currency reserves). The leeway to buy EUR would be constrained and that would put pressure on the EURCHF floor. The SNB will be forced to act by setting a fee on sight deposits then. This would spur capital outflow and weaken the CHF.

The pressure is mounting, as the EURCHF has been gradually nearing the floor. We probably need to see the EURCHF trading at, or below, 1.2010, to see the SNB intervene (just as during the euro area crisis). It is possible that we will see the 1.2000 touched, but only briefly (lowest during the cap history was the 1.19995 rate on April 5th, 2012).

Figure 1. Gold share has fallen over years

It is obvious that there have been some bets placed on the “Yes” vote. The EURCHF 3M implied volatility has risen by 2.5% points from August lows, and the risk reversals even in shortest maturities turned negative, for the first time since 2012. The options market is pricing a 40% chance of EURCHF under the 1.2000 floor in 3M.

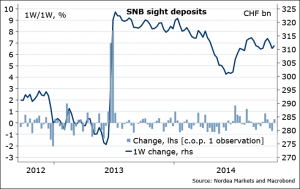

Figure 2. No interventions yet

The SNB’s decision to introduce the fee on sight deposits will be prompt (if ‘Yes’ vote on hold) – but the actual execution of gold purchases could take years. This is why we, even in worst case scenario, are comfortable in holding the EURCHF forecast unchanged, expecting more CHF weakness (EURCHF toward 1.30) as outflow from Switzerland resumes, for good reasons or bad.

Figure 3. Sticking to profile

Nordea