USD strength since summer can be explained by worsening global growth momentum, as it has usually been, historically. Stock markets, rates, oil prices, too, not driven by central banks – but macro trends. Is the worst behind now?

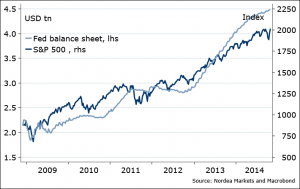

Surprisingly, quite a few people around were surprised that the US Fed stopping QE did not bring stock prices lower. It is usually assumed that has been the only reason the stocks went up…as it seems.

Figure 1. Easy

It’s just a common statistical fallacy: stocks trend up just as many macro variables.

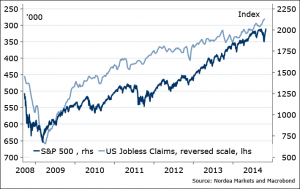

Figure 2. …Or not so easy

…And it is more likely the case that the stock market is macro driven than the central bank policy driven. The central bankers admit it themselves, read e.g. the notable speech from BoE Broadbent’s speech the week ago: central banks don’t drive economy or markets, they just facilitate them. Yes, the US Fed, and other central banks, have been just unlucky to end/pause easing when economic cycles rolled over in the past. But it’s just bad timing! Oil is a great example, recently – its decline has been consistent with the stronger USD, lower UST yields due to…

Figure 3. Lower global GDP growth consensus projections – dropping oil prices

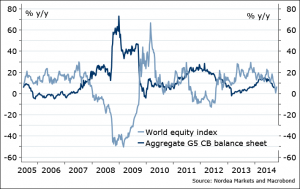

Stock markets? Still hold on, despite recent correction. But not thanks to central banks. To avoid the trend bias, take changes. Have a look – changes in central bank balance sheets vs changes it global stock prices. Except for a very recent period, which I see as aberration (helped by weakness in specific EMs), it has been the case that more central bank easing is actually consistent with lower growth in stock prices.

Figure 4. Change in stock prices NEGATIVELY correlated with change in central bank liquidity

USD historically, therefore, went stronger, on average, as Fed was easing. It still makes sense. The US Fed, being in charge of the world’s reserve currency, tries to blow against the wind too: when the USD strengthens, the USD rates are eased, and vice versa, so that the global USD monetary conditions are broadly neutral.

Recent example. USD strengthened last week as the US consumption was reported – first contraction in expenditure since January as the savings rate went up to 5.6%, 2 year highs. Just in line with the lack of lending in the housing market, as mortgage applications plunged 5% w/w last week. If the households are still net saving, cautious, this is one major reason holding the US current account deficit at just 1/3rd of the pre-crisis size, in help to the USD.

The Bank of Japan expanded QE last week – wow, good news for stocks, right? Not so fast. Nothing happens without the reason. If BoJ’s fears materialize, it will be far from good news for the world economy – but will be GOOD news for the JPY.

This week payrolls is the key data point: if wage growth accelerates above 2% pa rate finally (not the consensus, nor our expectation), of course the USD benefits on the news. But ultimately it would bring forward Fed tightening, support the US Treasury bond yields, and thereby bring closer the end of the USD strengthening, if history is to go by.

It does seem that the worst is behind for global cyclical data for now, with all respective market implications. If, contrary to expectation, global growth keeps disappointing, the EURUSD will test the multiyear channel support, 1.22-1.24 (our official 3M forecast at 1.24), below which we could target 1.10-1.12 levels, much faster than many project. And again, it is NOT if the US performs well and the rest catch up, but if the rest remain weak and the US catches down – the USD will gain much more, broadly, and in particular vs commodity and Asian EM currencies.

Nordea