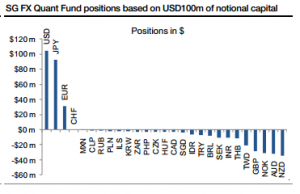

The SG FX Enhanced Risk Premia system has been building a long yen position comparable in size to the long dollar position throughout the week. The biggest longs remain USD and JPY complemented by a smaller long in EUR. The biggest shorts are the NZD, AUD, NOK and GBP.

The short position in the GBP/USD and the long position in the USD/NOK are the USD crosses with the highest combined momentum and IR-driven FX signals among the G10 currencies. Note that the magnitude of the long dollar signals has decreased substantially.

The SG Sentiment indicator has remained firmly in the risk-averse area. We have short exposures to G10 and EM carry baskets and we have closed the Asian carry basket due to a negative momentum signal. The risk of the aggregate strategy stands at around 12% annualised volatility.