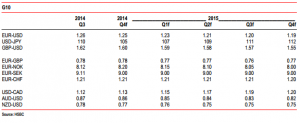

Our G10 forecasts have long encompassed a bullish USD theme, so the modifications here are ones of magnitude rather than direction. On this basis, the divergence in monetary policy between the Fed and the ECB will likely see EUR-USD much lower. Our forecast for the end of next year is 1.19, and the downside might be larger if we did not anticipate some push-back from US authorities against too swift a rise in the USD. After a fall from 1.40, one could argue that the prospective divergence in policy is already in the price of EUR-USD, but there is likely still a high level of market scepticism about whether the ECB will ultimately deliver full-blown QE. We believe they will, and so there is a further adjustment lower in the EUR to come.

We continue to look for GBP-USD to drift lower, with a 1.60 forecast for the end of 2014 and 1.55 for the end of next year. In part this reflects our wider bullishness on the USD, but it also takes account of our concerns regarding UK politics, the current account deficit and the recent run of softer than expected UK economic data.

Our forecasts for the AUD and NZD have both been revised lower, in part because of extra efforts locally to engineer a weaker currency. In contrast to other G10 nations, this aspect of the currency war is being driven by the more traditional issue of balance of payments adjustment rather than as a tool to combat deflation. New Zealand’s economy may be improving and further rate hikes are likely in 2015, but we would not fight the central bank’s desire for a softer currency. Australia’s rebalancing is moving slower than they would like, and the RBA will likely continue to counteract AUD rallies with verbal intervention.

HSBC