From the ECB policy meeting next Thursday, we expect more details on the ABS and covered bond purchase programmes but no full clarity about size and time horizon. The door will be open to whatever further it takes, which will allow the market to continue to price in further easing. Sovereign QE is not our base case.

It’s not easy to forecast a central bank that right now seems unable to forecast itself.

Last Monday, Mario Draghi said that the monetary policy framework is moving to “a more active and controlled management of (the) balance sheet”. Moreover he stressed the Governing Council was ready to “alter the size and / or the composition of our unconventional interventions should it become necessary”. That signals the ECB’s openness to do more – and be it in a trial and error-way. Things are obviously in a state of flux at the Governing Council and opinions are divided. That makes each and every policy meeting interesting and a possible source of surprises.

What seems reasonably certain to us is that

- policy rates have bottomed and will stay low for a long time

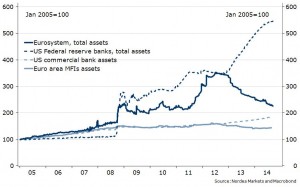

- the ECB wants to expand its balance sheet back to the early-2012 level. i.e. at least by € 700 bn, maybe more.

Balance sheets compared

More details about the ABS and covered bond purchase programmes will no doubt be in store. As indicated by Vice-President Constancio, the overall size of the programmes will probably not be announced. We don’t expect a specific time frame either but something like “over the medium term” or “within two to three years” instead. The notion of government guarantees for the riskier ABS tranches seems to have received an icy response from at least Germany and France. If the ECB cannot buy the riskier ABS tranches, the potential of the programme will be significantly curtailed.

Concerning the press conference, there is no way around seeing the main risk to the growth outlook being to the downside. Headline inflation coming down to 0.3% y/y or even 0.2% y/y in September will be no surprise for the ECB; the numbers will be published on 30 September. We expect Draghi to be very optimistic on the second TLTRO and on the feasibility and positive effect of asset purchases. After all, central bankers should be convinced by what they are doing so that they have a chance to convince others.

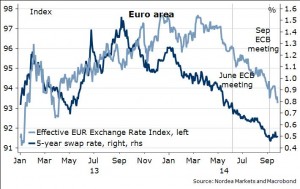

Draghi will probably also let his preference for a weaker EUR shine through. Moreover, we would find it logical and even necessary to tone down the importance of 5y5y inflation expectations for monetary policy. Movements in the – at times thin – inflation market do reflect more than changes in inflation expectations. Therefore, the 5y5y can only be one piece of information about medium term inflation expectations among others. Interestingly enough, Draghi referred to the 5y5y during his Jackson Hole speech in late August but did not so in Brussels last Monday.

QE or not QE?

What about sovereign bond purchases (QE in size)? The ABS and covered bonds purchases can be seen two ways: either as a prelude to QE or as the beginning of a way around it. QE is not part of our base case. In a nutshell, we are convinced that the Governing Council would prefer to avoid the legal, political and practical hassle associated with QE in a “one currency but 18 countries”- setup – all so more so as the economic benefits of QE are highly debatable. Still, the last thing the Governing Council wants is to seem it has run out of ammunition.

With a given balance sheet-target, there are two ways for the ECB to try to get around QE: either by expanding its universe of bonds to be purchased further to other marketable assets, like corporate bonds. Or by stretching asset purchases into the future. However, as the issue about needing guarantees for the riskier ABS tranches shows, the ECB remains wary of buying assets with more notable credit risk. There is thus a limit to how big a purchase size the ECB could reach without sovereign bonds.

Buying bonds worth € 700 bn over three years roughly means buying almost € 20 bn per month. Doing it within a year means buying € 58 bn per month. While the latter seems impossible without including sovereign bonds, the former might be possible, but would need more than just ABSs and covered bonds.

We would have to change our no QE call after the ECB meeting next Thursday, if the ECB seems determined to reach an ambitious balance sheet target relatively fast, as we are rather sceptical about how quickly the ECB can expand purchases of only covered bonds and ABSs. Later on, possible triggers for changing our QE call could be inflation failing to pick up in Q4, a deteriorating economic outlook and disappointing demand also at the second TLTRO allotment in December. In this case, pressure on the ECB to empty the toolbox might be stronger than the good reasons to resist the pressure.

QE pricing to continue

Draghi’s message should leave the market free to continue to price in a higher chance of more easing to come. The ECB’s stance thus continues to support very depressed core yields, even tighter intra-Euro-area spreads and keep the euro under pressure.

The ECB should be happy at least regarding how the FX markets have taken their message

Nordea