Despite the recent disappointments in data, structural changes in Japan and global markets may lead to JPY weakening faster and stronger than we currently forecast. Exploit any short term JPY strength to position for higher USDJPY (medium term) and EURJPY (short term).

It is almost two years now since the call “JPY – the years of strenght over”. Looking back, the Japanese yen corrected the post-Lehman overshooting, and has resumed the weakness in summer. The USDJPY has broken to new highs. Why, and what happens next?

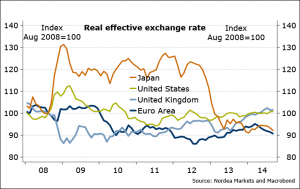

Figure 1. Back to square 1

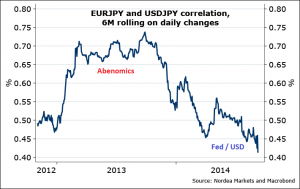

While the 2013 was the yen story – seen from positive high EURJPY and USDJPY correlation – this year, since June, it has been mainly a “strong USD” story, as the EURJPY and USDJPY have decoupled.

Figure 2. This round is not about Abenomics

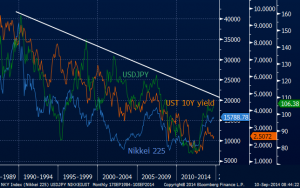

The market participants typically watch the key ”drivers” for USDJPY and EURJPY. Ever since Lehman crisis in 2008, it has been common to see higher stock prices and/or higher US/German government long term yields to be associated with higher USDJPY and EURJPY. This will probably keep working, at least in the short term.

True, that correlations are not stable – and before the Lehman crisis, it was hovering around zero for many years. But the average historic correlation on daily changes has been positive, and in none of the 3-month period since 80s it has dropped to a larger negative value (0.5) than risen to a positive one (0.8). More importantly, the trend – the Nikkei 225, the USDJPY/EURJPY, the US government 10Y yield – has been shared over the past few decades. So, breaking any one of these is a “confirmation”, or reinforcement for the rest.

Figure 3. Common trend

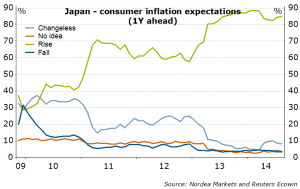

What does it take to break the US government 10Y yield up, Nikkei 225 stocks higher? Inflation, both in the US, Europe and Japan, which we, it seems, are going to see creep higher in the coming year. There is little doubt about inflation is broadening in the US, and we expect inflation to pick up also in Europe soon. But what about Japan? While I myself have highlighted the risks of fading JPY weakness to the CPI earlier this year, it may be that “this time is different”, and short term pressures on core inflation will overwhelm the past JPY stability/strength effect – something that the market participants still seem doubtful about.

Abenomics have succeeded in some ways. In particular, inflation has risen as the labor market has tightened, with unemployment rate close to 20-year lows, the output gap has been almost closed, and the nominal wages are back growing at the rate fastest rate since 1997. Barring the data disappointments in Q2 and over summer, mostly due to the VAT tax hike in April, consumer confidence has recovered since, and inflation expectations are firmly on the upside.

Figure 4. Consumers expect higher inflation now

What if recovery resumes in Japan / real wages pick up – will rates rise and support JPY? It is clear that Japan cannot afford much higher rates – and it won’t have to. Divergent potential growth rates between the US, EMU and Japan, mostly due to demographics, will likely keep the interest rate spread in favor of the former, and that will also be in BoJ’s interest. Best case (and our base case), the BoJ will not have to ease more, but then – if that happens for good reasons – the Japanese stock market, trending down for years, and relatively cheap, will resume its rise, breaking the multi-year downtrend.

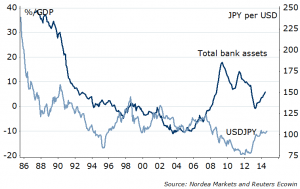

Another salient trend, highlighted back in 2012, is the resumption of the dissaving in Japan. Indeed, the Japanese household savings rate, after a temporary shock, has resumed the fall, is currently negative just as the trade balance. Given the demographic trends, the trade balance will probably be only temporarily supported by the past JPY weakness. This means Japan’s relative international investment position (accumulated current account balance, adjusted for valuation changes), may turn against JPY in coming years, just as both the US and Europe have become more frugal and competitive after crisis. Meanwhile, the Japanese corporates, after many years, have finished deleveraging (trend supporting JPY), and the total bank debt/GDP has turned up, and has gone up since 2006. The net FDI outflow has only accelerated since, also to the JPY disadvantage.

Figure 5. Dissaving must go on…

Figure 6. Deleveraging over in Japan

All this combined, the chances of the USDJPY rising toward 110 (our official forecast for end-2015) and EURJPY toward 140 sooner have increased now. If we have seen the action we have without the UST yields moving much up, it probably doesn’t take much of the upside move (and our forecast for next year is UST 10Y at 3.5%) to bring the USDJPY above 110 – even 120, if not 130 in 6M-1Y. Be ready for that. Notably, in the options market, calls for the upside move are still slightly cheaper than puts in the 6M-1Y segment. Any downside in the short term, toward 104-105 in USDJPY spot (not unlikely, after the recent impulsive spike) should be taken as an opportunity to position for upside in the 6M-1Y horizon. Currently, the EURJPY is a better risk/reward for the short haul, it is rather likely it can overshoot our long term forecast (140) soon.

Figure 7. USDJPY toward 108…but EURJPY more attractive

Nordea