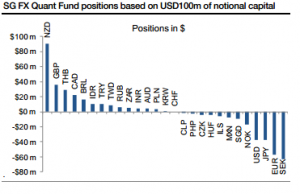

The most substantial change in the positions of the SG FX Enhanced Risk Premia strategy over the week has been the cut by around a third of the long NZD position. In addition, we have slightly increased the long GBP and short EUR positions as well halved the long CAD.

The biggest longs are the NZD, GBP, THB and CAD. The most sizeable shorts are the SEK, EUR, JPY and USD. The long positions in USD/NOK and USD/SEK are the USD crosses with the highest combined momentum and IR-driven FX signals among the G10 currencies.

The SG Sentiment indicator fell into risk-aversion area towards the end of last week and has oscillated between risk-neutral and risk-averse areas over the past few days. We remain long carry in G10 using 100% of the risk limit and long carry in EM and Asia using 75% of the risk limit.

The risk of the aggregate strategy is close to the target and stands at around 11% of annualised volatility. The strategy lost -1.22% over the week and it is up 0.9% so far in July.