AUD remains one of the most overvalued currencies in the G10. In simple terms, while the gap has narrowed between the real effective rate (REER) and the10yma from as much as 26.5% in 2011, AUD still remains about 5% overvalued based on this metric. More complicated econometric models (such as FEER and BEER) suggest fair value is south of 0.90 given Australia’s current account deficit, worsening terms of trade and limited productivity gains in recent years.

Our short-term fair value model, which incorporates rate spreads, equity prices, the VIX and commodity prices, suggests fair value is near 0.91.

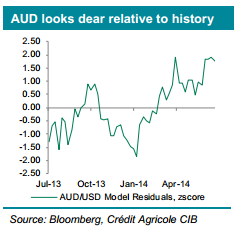

Moreover, the residuals of the model imply that AUD/USD is 1.75 standard deviations rich relative to its one-year average (see chart). Even so, with a sharpe ratio of 1.7 since the start of the year investors continue to pile into AUD in search of yield, despite its rich valuation.

With this mind, we suspect Australia’s employment report will do little to diminish AUD’s appeal this week against a backdrop of low volatility and steady US rates.

In fact, despite the latest round of profit taking, the combination of firmer China data and decent employment report from Australia should be enough to help AUD rebound to its recent highs near 0.95 against the USD, although we look to fade any rallies above this level. We also look for AUD/NZD to rise to 1.074.