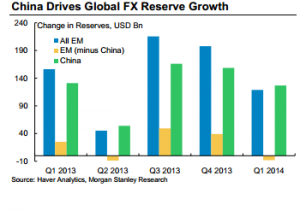

China continues to drive global FX reserve accumulation, with close to US$4 trillion in holdings. How has this affected global FX so far, and how will it continue going forward?

In fact, EM ex-China net sold FX reserves in 1Q14, while China accumulated over US$125 billion (see Exhibit 1). China’s FX purchases have meaningful impacts on global markets. They may well have contributed to the rally in US fixed income entering the year. And China’s diversification outside of USD can provide a cushion for other FX, most notably EUR, which serves as the world’s second major reserve currency.

Where’s the Money Going? After adjusting for valuation, we estimate that RMs bought over US$80 billion worth of EUR from 4Q13 through 1Q14. This provided meaningful support for the common currency, in addition to the private sector inflows to riskier eurozone assets. All in, RM divestment from EUR stabilized last year and is now ticking gradually higher, with the EUR share of EM reserve holdings nearly back to 25%. RMs have also been healthy buyers of CAD and JPY.

What’s Next? Over time, China’s FX reserve accumulation is likely to slow, in line with intended liberalization of RMB, policy-makers’ desire for a more flexible domestic monetary policy, and global rebalancing.

We have shown previously that, at least in the case of EUR, RMs tend to rebalance opportunisticall. In other words, they buy on dips and sell on rallies, thereby reducing volatility. A structural decline in reserve accumulation and diversification will have the effect of lifting suppressed FX vol, in our view. It would also likely allow EUR to trade lower, more in line with underlying fundamentals such as rate differentials.