The USD is the dominant global funding currency; hence it makes a fundamental difference if the Fed, rather than other central banks, normalizes interest rates. Higher USD rates have global implications by pushing global funding costs higher.

As long as USD funding costs stay range bound, peripheral G-10 currencies will likely also stay range bound.

Currency weakness can generate imported inflation, raising rate expectations even in an otherwise deflationary global surrounding.

Range trading currencies have helped keep FX volatility low, but once the FX market breaks away from the range trade witnessed over recent quarters, volatility should push higher.

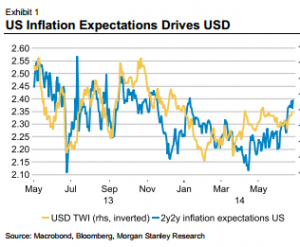

We expect the analysis of US inflation dynamics to stay in focus.

The Fed’s Yellen has denounced the recent rise of inflation as ‘noise’ and as long as wage growth remains subdued not only will Fed rhetoric remain accommodative, the US will not contribute to reducing global deflation pressures.

However, matters will change should US inflation pick up from here. Then global deflation pressures will ease, breaking the trend of mean reverting currency markets pushing volatility higher. US inflation expectations as measured by the 2y2y have reached their highest level since January. FX markets should take notice.

MS