Past JPY weakness to help One of the major disappointments for Japan over the past few years was the rapidly deteriorating trade balance, which dragged Japan’s current account into negative territory for the first time in history. This has also been one of the reasons for investors to sell the JPY. Most of this negative trend is mainly to be blamed on global demand. The most recent foreign trade data (May) are still very weak with exports to all regions except for the EU stagnating (in y/y terms) and PMI export orders at 49 for two months in a row. So, not really any reason for optimism just yet! But still, if our economists are right, global growth will pick up in H2, supporting Japan’s trade data.

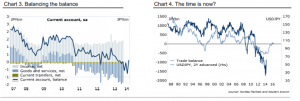

Equally important is the so-called “J curve” effect – the delayed impact of currency weakening. If history is any guide, the effect of JPY weakening takes up to two years to show through in net exports. Consequently, the effect of last year’s JPY weakening on trade only starts working now (Chart 4). Japan’s current account balance has already turned positive again this year (Chart 3). The key driver is still net income from abroad, which last year rose to the highest level since 2010. But even the trade balance stopped widening, and now the key is to sustain this development. The improving current account should, other things constant, prevent further JPY weakening. External factors matter too.

Our official forecast is unchanged: USD/JPY at 102 in three months. Speculative net short JPY positions have increased again over the past few weeks, remaining at more than two standard deviations above the historic mean. Thus, the risk of JPY strengthening remains, should volatility increase.

Looking at external factors, a sharp rise in USD rates, eg UST 10Y above 3% (ideally without the effect of higher volatility and lower stock prices) is needed for USD/JPY to break above 105. This is probably not around the corner, as the Fed has yet again signalled complacency and a willingness not to rush to the exit from its ultra-easy monetary policy.

Technically, USD/JPY and EUR/JPY are contained in the range for the coming weeks. The break below 101.60 signals more USD/JPY downside, and the break above 102.80 would be a signal to buy short term.

Nordea