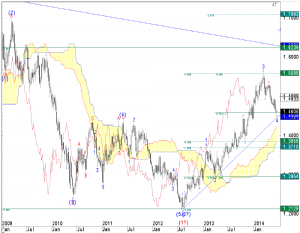

As the big picture below shows the market is currently testing key-support between 1.4582 and 1.4464 (int. 38.2 %/weekly trend) which can be seen as the decisive T-zone on big scale.

The defense of it would leave the door wide open for a potentially missing 5th wave advance towards 1.6239 (int. 76.4 %), but at least to 1.5308/45 (pivot/minor 76.4 %), assuming we have seen a trend reversal at 1.5588.

For a broader recovery to be supported though it takes breaks above 1.4766 (daily trend) and ultimately above 1.4844 (minor 76.4 %)..

A decisive break below 1.4464 would on the other hand constitute a game change in favor of a much deeper IInd.-or B-wave setback to 1.3858 (50 %) and to 1.2945 (76.4 %) at a later stage.

JP Morgan