The Chinese HSBC flash PMI staged a stronger-than-expected pickup to 50.8, the highest in six months and exceeding 50 for the first time in 2014, notes BNP Paribas.

‘This indicates that economic growth is strengthening, and a near-term hard landing is unlikely despite of the ailing property market. As such, our economists expect sequential GDP growth to rebound from 1.4% q/q in Q1 to 1.9%q/q in Q2. Still, given the historical response of the economy to mini stimulus and growing symptom of stimulus fatigue, we believe the thrust can only last a quarter or two, and growth may re-decelerate in Q4,” BNP adds.

What does this mean for commodity currencies?

“In the short-tern for FX, the commodity-linked group of AUD, NZD and CAD should continue to perform strongly,” BNP projects.

How to play it?

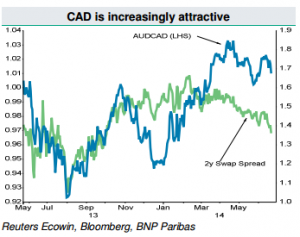

“For several weeks now CAD has been our favoured among this group given the ongoing upside surprise in inflation, undervaluation vs commodity process and short market positioning. Long CAD looks attractive vs both EUR and AUD,” BNP advises.