The following are the latest weekly positions updates on Societe Generale’s FX Quant Fund which runs systematic currency strategies by SocGen’s quant analysts.

The SG FX Enhanced Risk Premia strategy has started to deleverage its pro-risk positioning during the past week.

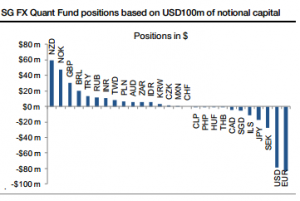

The biggest longs of the combined strategy are NZD, NOK and GBP. The most sizeable shorts are EUR, USD and SEK. The most notable changes over the week are the flattening of the long AUD and short JPY positions.

The long position in GBP/USD and the short position in USD/NOK are the USD crosses with the highest combined momentum and IR-driven FX signals among the G10 currencies.

The SG Sentiment indicator has stayed in the risk-neutral area and on occasion has come close to the risk-aversion threshold. We remain long carry in G10, EM and Asia. The respective capital allocations as a percentage of the risk limits are 100% in G10, 100% in EM and 25% in Asia.