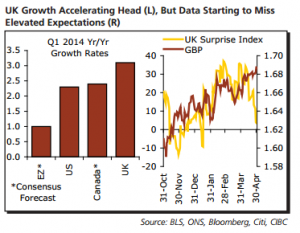

It was confirmed this week that the UK economy is the mightiest of developed economies at the moment, with the 2.7% annualized rate in Q1 looking even better when judged against the US stagnation.

In this regards, CIBC World markets thinks that while the UK GDP data was enough to see GBP/USD touch 5-year highs. it also highlighted potential problems for sterling ahead.

“While strong, the increase was slightly below consensus expectations and the BoE’s estimate. We are far from bearish on the UK economy, but forecasts may have gotten too bullish and downside misses in economic data are already becoming more prevalent,” CIBC argues.

“That could soon start to weigh on the Pound, especially against the US$ as the economy stateside accelerates sharply in Q2,” CIBC projects.