Westpac G10 FX model portfolio opens a decent long USD exposure for the week ahead, triggered by a long USD signal from its US surprise index model.

“In the wake of last week’s stronger than expected retail sales, industrial production, jobless claims and Philly Fed our US surprise index has burst higher. This is the first US data surprise index signal for the year and just the third in the last 16mths. All other things equal our portfolio will have a decent bullish tilt on the USD for the next several weeks, betting on yet further improvement in the complexion of the US data,” Westpac clarifies the rationale behind the shift towards a bullish USD view in its FX model.

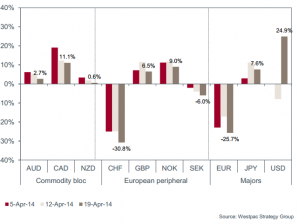

“The bullish USD surprise index signal is absorbed equally across all currencies. Each of our prevailing long currency positions over the last few weeks – AUD, CAD, GBP, NOK and JPY – have thus been pared back, while each of our favoured model short positions for the last few weeks – CHF, EUR and SEK – have been increased,” Westpac adds.

All in all, what is Westpac G10 FX model portfolio buying and selling this week?

“Beyond the USD, CAD, GBP and NOK remain our favoured currency long positions, while EUR and CHF remain our core short positions for another week,” Westpac outlines the current holdings of its FX model.