No further easing at this point

Mr Draghi mentioned two key reasons why the Governing Council decided against easing policies further. The first reason is that the new staff projections by and large confirmed the previous assessments of a gradual recovery, and low inflation for a period followed by a gradual return of inflation to 2%. The second reason is that key figures out since the February has be positive.

Mr Draghi also noted that none of the two triggers put forward in January has been hit. If anything, money markets have normalised and the medium-term inflation outlook was confirmed by the new staff projections.

Mr Draghi noted a broad discussion on changing interest rates and other policy instruments, which presumably means SMP sterilisation. What the Governing Council did agree to was that the slack in the economy is large and will be reduced very slowly. Thus, rates will remain low even when the economic outlook improves.

Market reaction

Rates: The market reception to zero delivery was quite predictable. Rates up across the board, with e.g. the 5Y EUR swap up almost 8 bp at one time to almost 1.06%. In the short end – where some ECB action was anticipated by some – the Eonia curve inversion also faded immediately. For instance, while the 3M Eonia swap is up about 3 bp, 6M3M (3M, 6M forward) increases over 4 bp, and now lies only marginally below the 3M spot contract. This is indicative of not only immediate disappointment but also future ECB action being priced out, though not fully as the Eonia curve remains slightly inverted.

Inflation: The divergence between the ECB’s inflation assessments and that of the inflation swap market is still there, with the ECB seeing 1.5% for 2016 (1.7% for 2016 Q4) against the markets 1.21% (1.3%). However, that discrepancy has been fading over the past weeks, and the longer end, in the form of 5Y5Y continues to lie around 2.13-2.15%. Immediate reaction on the short inflation swaps was for 1Y swap to tick down about 3 bp.

Trades: Given our non-action call, we have been proponents for paying 6M3M. We also like to be long EUR volatility (gamma straddles in particular) over the coming period. As a very short term correction trade we favor 5s10s steepeners, as 5Y – as almost always – reacts the strongest and the fastest.

FX: Mr Draghi mentioned that the strengthening of the EUR since lows of 2012 has lowered inflation by 0.4% points. Yet later he said that it is rather difficult to judge, since the recent strengthening of EUR is just a reversal of the previous weakening, stressing that exchange rate is not a policy target. The EUR has strengthened broadly, the EUR/USD has hit new highs of 2014 during the press conference (1.3829) as the EUR/GBP has come above the 50D moving average (0.8264), signaling potential momentum shift.

New staff projections

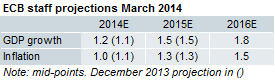

The new staff projections showed a moderate upward revision to the growth forecast for this year. The new growth forecast for 2016 was put at 1.8%, which seems fairly high in our view.

The new staff projections for inflation showed a slight downward revision for this year, as widely expected, but an unchanged medium-term outlook based on the 2015 forecast. Moreover, the new projection for 2016 was put at 1.5%, which seems fairly low, but Mr Draghi put the Q4 2016 at 1.7%, which seems more in line with our view.

Looking ahead

We believe the ECB is done easing. The economy is improving and we expect inflation to bottom in March and move up just a bit.

Risks remain. The March inflation number will probably be the lowest in this cycle; we would be surprised not to see some lagged weakness in EUR PMIs stemming from weakness in both the US and China; and money market conditions may be affected by the ongoing Asset Quality Review and stress tests. Thus, the easing bias will remain for some time.

Nordea