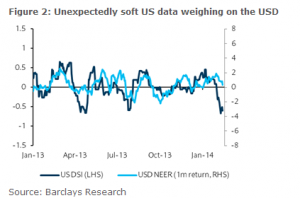

“The risk sentiment stabilized last week, helped by the US Congress’ passing of a “clean” debt-ceiling bill that extended the debt limit until March 2015, and robust trade data from China, among other things. In addition, soft US data weighed further on the USD, making it a notable underperformer of the week, especially against currencies where recent local data and/or the central bank communication paint relatively more hawkish picture such as GBP, NOK and NZD.

Soft retail sales and industrial production numbers for January and downward revision to previous months revealed that the US growth momentum was slower into year-end than initially suggested by preliminary Q4 GDP data. While our Q4 GDP tracking estimate declined to 2.3% q/q compared with preliminary release of 3.2%, we note that this is more in line with our modest US growth forecast for 2014 (2.5% Q4/Q4) and expect the negative weather effect to wear off over the next few months.

Given the weather-related uncertainty on US economic data, the USD is likely to remain under pressure in the very near term, but we continue to expect it to re-gain upward momentum throughout the year as the transitory weather effect dissipates and it becomes clear that the underlying strength of US economic recovery remains intact.”