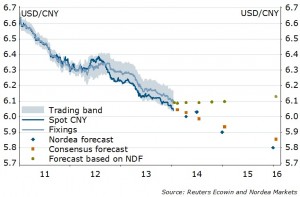

Four months have passed since our last CNY forecast update in September 2013. As we expected, the CNY has maintained a strengthening trend vs. the USD. The actual pace of appreciation was slightly faster than we predicted. Interestingly, the USDCNY appeared to have followed a staircase movement since August, where a period of relatively sharp appreciation was followed by a period of flat development.

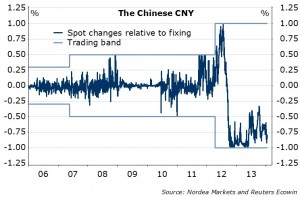

Because of the time factor, we revise our 3M forecast from 6.1 to 6.0. For end of June 2014, we actually see the chance of a limited depreciation against the USD. The argument is that the trading band in which the spot CNY is allowed to deviate from the central bank daily fixing rate, currently standing at +/- 1%, is likely to be widened in March-April (after the Chinese New Year holiday). To demonstrate that the CNY is no longer a one-way bet, Beijing may have an incentive to weaken the yuan immediately after the band widening. At least it happened in April 2012. On a longer horizon, we still expect the CNY to gain vs. the USD.

Nordea