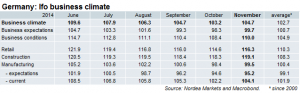

Ifo index up against expectations. However, the economy is unlikely to pick up significantly during the winter half-year. We lower our growth forecast for next year to 1.1% (from 1.5%).

This was the first increase in the ifo index since April. The improvement was broadly-based, concerning both the assessment of the current situation, expectations and sector-wise retail, construction and manufacturing. Still, for the main index and expectations, it was the second-lowest reading this year.

The number today don’t add to the ECB’s worries, but don’t take presssure away from the central bank. Ifo expectations still point towards weak investment activity in the winter half-year. Is not only geopolitical uncertainty that holds back investment. It’s also the expectation of continuously weak demand from important trading partner countries like France and Italy. Moreover, the Grand Coalition government for now has favoured social policy over business-friendly policy so that many companies don’t feel that the climate for investing in Germany is very good.

A lower growth forecast for Germany

We pencil in GDP growth of 0.1% q/q in Q4 (as in Q3), so that the economy enters 2015 on very low momentum. Because of the lower carry over from 2014 into 2015, we revise our 2015 forecast for German GDP growth down to 1.1% (from 1.5%). We expect weaker growth in exports and capital spending than before. We still expect growth to be mainly driven by private consumption. On top of the robust labour market, lower oil prices are like a stimulus programme at the right time. Carburant prices are currently on a 4-year low. The flipside of a much reduced import bill are weaker exports to oil exporting countries, most of all Russia which is Germany’s energy supplier number one. A relatively subdued outlook for exports means that capital spending will probably not pick up very strongly.

Nordea