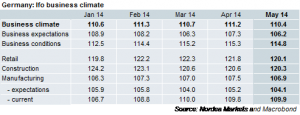

Both yesterday’s PMI and today’s Ifo numbers confirm the good state of and decent outlook for the German economy, both in terms of the level of growth and its broad-based composition. However, given the decline of expectations over recent months and the strong impression that the current situation component has peaked, one should expect healthy growth going forward but no boom.

Short term risks for the economy include a further weakening of important emerging economies and a stalling reform process in major Euro-area countries like France and Italy. In that respect, the outcome of the European Parliament elections, that could give EU-/euro-sceptic parties a boost in both countries, could be important. Over the longer run, with monetary policy likely to stay loose for long (and probably getting even looser soon) and a weaker EUR supporting exports, bottlenecks could appear. It would be fiscal policy’s task to counteract by restrictive measures, but at – as in any other countries – that would be quite unpopular.

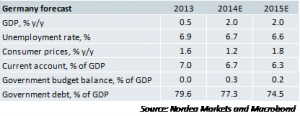

Slight revision of 2014 GDP forecast

Detailed GDP numbers for Q1 this morning confirmed domestic demand as the key driver of the economy. Private consumption rose by 0.7% q/q, capital spending by 3.2%. As it has been mentioned many times, mild winter weather played a role so that the usual spring revival of the economy will be less pronounced than usual. However, given the strong start into the year and our expectation that (slower than in Q1) growth will go on, we revised up our GDP forecast for this year to 2% (from 1.8%).

Nordea