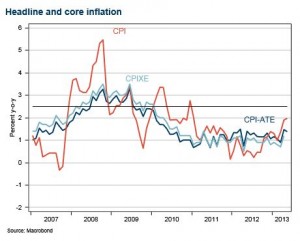

• CPI at 2.0% and CPI-ATE at 1.4% in May

• Inflation pulled up by airfares and food prices

• Inflation in sum slightly higher than Norges Bank expected since March, interest rate cut clearly off the table

CPI at 2.0% y-o-y and CPI-ATE at 1.4% y-o-y in May

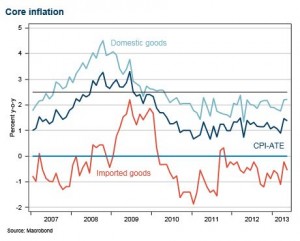

From April to May, headline inflation, measured by CPI, rose by 0.1%, resulting in 12-month growth of 2.0%. Core inflation, measured by CPI-ATE rose by 0.3% in May, resulting in 12-month growth of 1.4%. We and Norges Bank had expected 12-month growth in CPI and CPI-ATE of 1.6% and 1.0%, respectively. The greatest contributor to the monthly price growth was airfares, which increased by 18.6%, mostly due to a rise in the cost of domestic flights. This is an extremely volatile series, making it hard to interpret whether the rise in prices is only due to the high number of holidays in May this year or to a more persistent increase in airfares. Prices were also pulled up in May by higher-than-expected food prices. Imputed rentals for homeowners and actual rentals for housing also pushed prices up in May. As expected, headline inflation was pulled down by electricity prices, including grid rent. Imported prices also fell in May. May numbers for the CPIXE, Norges Bank’s preferred measure for core inflation, will be released by Norges Bank at 14:00 today. Norges Bank expects CPIXE of 1.0% in May.

Inflation in sum higher than Norges Bank expected since March, interest rate cut clearly off the table

The 12-month growth in core inflation, measured by the CPI-ATE, has in sum been 0.6 percentage points higher than Norges Bank expected in March. As noted, some of the price increase in May is due to the very volatile airfares, but the other core price components also increased more than expected. Given the inflation trend, we believe an interest rate cut is clearly off the table next week. We do, however, believe Norges Bank will lower the interest rate path, as several factors affecting the key policy rate have been softer than expected since March: lower interest rates abroad, weaker growth and growth prospects abroad, a weaker labour market in Norway, and seemingly weaker-than-expected wage growth this year. Norges Bank’s regional network report for Q2, due out of Friday, will be the last important piece of information before the policy meeting next week. A weak report, as indicated by the last regional update, would contribute to the lowering of the interest rate path. However, with inflation being higher than expected, the downward revision should be smaller than the 25 basis points we had expected up until today.

Handelsbanken