Job growth remained brisk in December, reinforcing our view that the economy’s fundamentals are strong enough to weather the economic turbulence abroad. Although today’s employment report was a mixed bag, the strong jobs data support the case for lift-off in rates later this year. Thus, we continue to look for the first Fed rate hike in June 2015, but this is based on the expectation that we soon will see signs of significantly stronger wage pressures than in today’s report .

December payrolls rose 252k and with a 50k net upward revision to the two prior months the net increase was 302k, significantly stronger than the consensus forecast of 240k. Our estimate was 220k. In 2014 as a whole, payroll gains averaged 246k per month, significantly up from the 194k trend in 2013.

December marks the 11th consecutive month of job gains above 200k, the longest such stretch since 1994. And with jobless claims consistently below 300k payrolls growth should remain well above the 200k mark. Anything over 125k jobs per month will keep the unemployment rate trending down unless the participation rate starts increasing sharply (something we don’t expect).

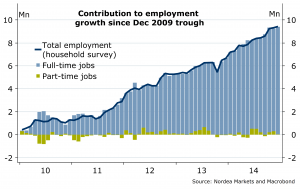

Since the trough in December 2009 employment is up 9.429mn, of which 2.771mn jobs were created in 2014 (according to the household survey). Many seem to believe the significant number of new jobs are mainly low-quality, part-time jobs. However, a more careful look at the post-recession data shows that of the additional 9.429mn people employed over the past five years, 9.375mn (99.4%) are employed full-time (see chart).

The solid trend in employment growth reinforces our view that the economy’s fundamentals are strong enough to weather the weakness in Europe, Japan and China.

The unemployment rate dipped a more-than-expected 0.2% point to 5.6% in December, the lowest since June 2008. However, the drop in unemployment was mainly due to a 273k drop in the labour force as the participation rate fell to 62.7% from 62.9%. Employment reported in the household survey was up a modest 111k in December after November’s weak 71k gain (revised from 4k)

We expect unemployment to hit the Fed’s NAIRU estimate of 5.4% – the level consistent with full employment – by mid-2015 at the latest.

The so-called U-6 unemployment rate, which counts total unemployed plus those employed part-time for economic reasons and those not in the labour force who would take a job if one were available, fell to 11.2%, the lowest since September 2008, from 11.4% in November.

A major weakness in December was a 0.2% decline in average hourly earnings in December after a 0.2% gain November, which was revised down from the initially reported 0.4% rise a month ago. The consensus estimate was +0.2%. Year-over-year average hourly earnings growth was 1.7%, down from 1.9% (revised from 2.1%) in November and below the range this measure has occupied since late 2012.

The still-weak hourly earnings data clearly support Fed Chair Yellen’s view that there might be pent-up wage deflation in the US labour market. However, we continue to believe that wage pressures are firmer than suggested by the, in our view, poorly measured wage data in the jobs report.

Moreover, as unemployment moves even closer to the level consistent with full employment more clear evidence of wage pressures should begin to materialise in H1 2015.

In other words, we expect to see more evidence that would make the Fed “reasonably confident” that still-low inflation will eventually rise towards its 2% target – a necessary precondition for initiating rate increases according to the December FOMC minutes.

Finally, the workweek was unchanged at an elevated 34.6 hours, a post-recession high just shy of the 34.7 hours pre-recession peak.

On balance, we continue to look for the first Fed rate hike in June 2015, but this is based on the expectations that we soon will see signs of significantly stronger wage pressures than in today’s report. According to the fed funds futures contracts, the first 25bp rate hike is fully priced in in early October.

Details, December:

Payrolls, change: 252k (consensus: 240k; Nordea: 220k; prior: 353k – revised from 321k)

Payrolls, net revision to two prior months: +50k

Unemployment: 5.6% (consensus: 5.7%; Nordea: 5.7%; prior: 5.8%)

Change in employment, household survey: 111k (consensus: 310k; prior: 71k – revised from 4k)

Labour force participation rate: 62.7% (prior: 62.9% – revised from 62.8%)

Average hourly earnings, m/m: -0.2% (consensus: 0.2%; Nordea: 0.2%; prior: 0.2% – revised from 0.4%)

Average workweek: 34.6 hours (consensus: 34.6; prior: 34.6)

Nordea