S labour market data have been decent, but December job growth will not duplicate November’s very strong 321k increase. We expect a 220k gain in nonfarm payrolls; somewhat below the 240k consensus. The case for a below-consensus gain in payrolls is supported by the fact that December payrolls have had a tendency to disappoint for some years. Ignore today’s strong ADP employment estimate.

The consensus forecast is a 240k gain in nonfarm payrolls with a standard deviation of 27k, so anything between 215k and 265k should be within the range of expectations. A number below that will probably diminish expectations of a Fed rate hike and be USD negative, while above that is likely to accelerate expectations of a Fed hike and boost the USD further.

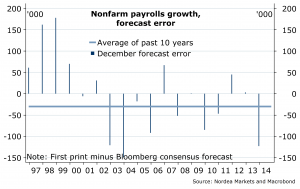

As usual, there is significant uncertainty around this estimate. Thus, with a standard forecast error – first print minus consensus forecast – on nonfarm payrolls growth of 87k, the 95% confidence interval extends all the way from 66k to 414k jobs.

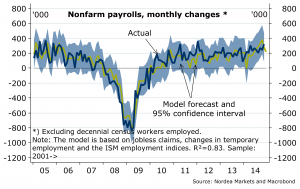

We expect a 220k gain in nonfarm payrolls; somewhat below the 240k consensus estimate but roughly in line with the trend over the past year or so and in accordance with the prediction of our econometric model, which is based on jobless claims and employment indices from business surveys (see chart). (Our early estimate from just before Christmas was 230k.) See below for more reasons behind our below-consensus call.

The unemployment rate looks likely to fall from 5.8% in November to 5.7%, assuming a stable labour force participation rate and a solid gain in household employment. The consensus estimate is also 5.7%.

We forecast a more muted 0.2% rise in average hourly earnings after November’s 0.4% increase, in line with the consensus estimate. Theworkweek was probably unchanged at an elevated 34.6 hours, a post-recession high just shy of the 34.7 hours pre-recession peak.

December payrolls tend to disappoint

The case for a below-consensus gain in payrolls is supported by the fact that December payrolls have had a tendency to disappoint for some years. Thus, over the past 10 Decembers the forecast error has averaged 30k (see chart).

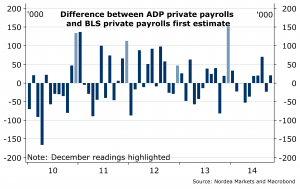

Part of the reason for this apparently systematic overshoot in consensus expectations in December might be because the ADP estimate of private payrolls in recent years has tended to overstate growth in payrolls in December (see chart). For example, in December 2013, the ADP estimate was +238k versus +196k for the official (first estimate of) private payroll data according to the Bureau of Labor Statistics; in December 2012, the ADP estimate was 215k versus a BLS figure of 147k; and in 2011, the ADP estimate was 325k versus a BLS figure of 140k.

Why? Reportedly, firms providing the raw data behind the ADP employment estimate wait until December to delete payroll records for those separated during the year. With fewer layoffs in 2014 than in 2013 (and fewer in 2013 than in 2012), the December ADP numbers may therefore be inflated as seasonal adjustment flaws could have led to an over-compensation.

For the same reason we strongly recommend to ignore today’s ADP report, which showed a 241k increase in December employment versus a 225k consensus estimate.

Wild card: Weather effects

As always at this time of the year, a potential risk factor to payrolls forecasts is the impact of the weather. This time the risk might be skewed to the upside.

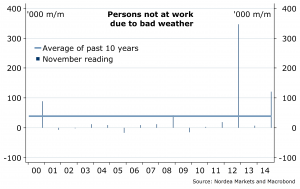

First, across much of the country it was warmer and drier than normal in the December survey week. Second, there were some signs of negative weather effects in November. Thus, according to the household survey, the number of workers not at work because of the weather was 153k in November; a 121k increase from October. As this 121k increase is a not seasonally adjusted figure, we compare it with the average swing of +39k over the past 10 years (see chart). The difference probably overstates the impact on payrolls because the series includes many persons who are still being paid and thus still included in payrolls. However, the direction is probably telling of the weather impact on November payrolls.

As the weather has turned more favourable in December, we could therefore see a positive impact on employment in Friday’s jobs report. However, due to the significant uncertainty we have chosen not to include such an effect in our forecast.

Nordea