While German consumers can be happy about stable prices, the ECB must be worried about too low inflation expectations. We revise down our forecast for Euro-area inflation to -0.1% y/y in December. The numbers will be published this Wednesday.

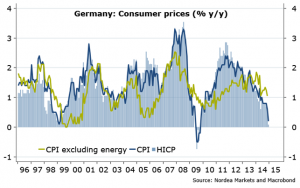

German inflation fell to 0.1% y/y in December, from 0.5% in November. This is the harmonized measure of consumer prices important for the ECB. It is the lowest print since October 2009 and very likely not the low point of the current cycle.

Energy prices – accounting for 11% of the goods basket – are now down by 6.6% over the year. While the total rate of inflation is likely to turn negative soon, Germany does not face a negative kind of deflation. The inflation rate ex food and energy actually rose to 1.4% y/y. This is “lowflation”, not deflation, not least because wages and unit labour costs are rising.

Apart from the German numbers, we know that consumer prices fell by 1.1 y/y in Spain, a steeper drop than expected. We revise down our forecast for the December Euro-area HICP to -0.1% m/m and -0.1% y/y. The first negative reading since October 2009 would increase the pressure on the ECB to announce the next phase of policy easing already in the upcoming policy meeting on 22 January. We expect an unchanged core rate at 0.7% y/y. An ECB with an objective defined in terms of the core rate would feel less pressure to act.

Nordea