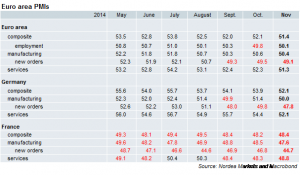

Weakness in manufacturing far from over. Services undershoot in Germany.

In line with consensus, we have been too optimistic in expecting that Euro-area PMIs will rise a bit in November. While the manufacturing PMI declined only a touch, the service component fell by a whole point. So the message is that 1) that weakness in manufacturing is far from over, 2) the weaker euro is not a big help so far, and 3) the service sector might not be immune.

Slow growth in Germany

In the German manufacturing sector, the new orders and new export orders components dropped sharply, driving the manufacturing PMI down to 50.0. Also services took a hit, but that could be an erratic move as there are few other signs that the domestic economy is slowing a lot. We feel comfortable with our view that German GDP growth in Q4 will be in same order of magnitude as in Q3 (0.1% q/q).

France: services up, manufacturing down

The French composite index rose a bit, but manufacturing still looks ugly. In a sense, France can be happy that the manufacturing sector is relatively small so that a recession there does not harm the overall economy too much. As seen in 2011 and 2012, manufacturing production declining doesn’t have to mean recession.

French PMIs don’t have much to do with actual GDP growth. But at least, they indicate that the 0.3% q/q increase in GDP in Q3 was a positive outlier.

Is there a need to say that bad numbers will increase both deflation worries and the pressure on the ECB to act? Probably not.

Nordea