We expect today’s jobs and ISM reports to show continued solid improvement. All eyes on average hourly earnings.

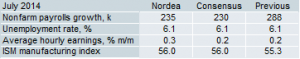

We expect a 235k gain in nonfarm payrolls in July following the surprisingly strong 288k rise in June. So another solid report, actually the sixth in a row with more than 200k new jobs if we are right. The consensus is 230k with a 24k standard deviation.

Anything over 125k jobs per month will keep the unemployment rate trending down unless the participation rate starts increasing sharply (something we don’t expect). In the last five months the average payrolls gain amounted to 248k, the strongest pace since 2006.

In line with consensus we expect an unchanged unemployment rate at 6.1%, but risks are tilted towards a 0.1% point decline.

Our primary focus is currently on the wage data. Average hourly earnings increased by 0.2% m/m in May and June. We expect a 0.3% gain in July, which would reinforce the impression that the labour market is tighter than the Fed believes. Consensus: 0.2%.

Payrolls growth stronger than 250k would probably lift bond yields and the USD, while the opposite could be the outcome with payrolls growth below 200k. Almost no matter what, we expect the Fed to remain on QE tapering autopilot.

We expect the ISM manufacturing index to rise to 56.0 in July, which would be the highest score this year, up from 55.3 in June. The consensus is also 56. A rise from an already high level has already been signalled by most of the regional manufacturing surveys. However, yesterdays’ unexpected drop in the Chicago PMI from 62.6 to 52.6 points to some downside risk for today’s ISM index.

Nordea