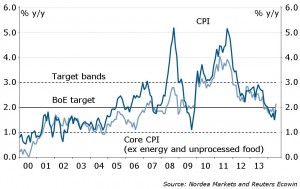

CPI came in at 0.2% m/m in June pushing inflation up to 1.9% y/y, much higher than the consensus estimate of 1.6%. The higher numbers will intensify the speculation of whether the Bank of England could tighten policy already this year. We find such a move unlikely.

The main contribution to the increase came from the clothing, food & non-alcoholic drinks and air transport sectors. Core inflation (excluding energy and unprocessed food) saw an even bigger rebound, rising from 1.7% y/y to 2.2%.

The significance of the rebound in inflation should not be overplayed. UK inflation numbers have been quite volatile on a monthly level lately, and the June increase only brought inflation back to a level seen early this year. It is too early to argue that the trend of falling inflation would have reversed. However, together with the strong momentum in the UK economy in general, the numbers will only add fuel to the speculation fire of when the Bank of England could deliver the first hike. After the numbers, the first hike is now roughly in prices in the beginning of next year.

Despite better growth prospects and the jump in inflation, we still find notable spare capacity in the UK economy, which means the Bank of England will not be in a hurry to start tightening policy.

UK inflation with a big rebound in June

Nordea