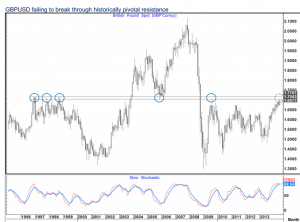

GBP/USD has been testing a historically pivotal area around 1.7040-1.7170 but has failed to sustain a rally through there, notes Citi FX Technicals.

“Monthly momentum is now the most stretched it has been in over 25 years. Daily momentum has now crossed lower from the most stretched level seen this year,” Citi adds.

“The UK economic recovery appears to be taking hold..However, all that information appears to be priced into the currency pair. None of the recent GBP-positive data or commentary has led to an accelerated move higher through resistance, suggesting that GBPUSD may be overbought,” Citi projects.

“At this point, the chance of a pullback after failing to break above the historically pivotal area seems likely, especially given the stretched momentum and positioning. The risk/reward dynamic is also attractive at this level as the stop is relatively close and the pullback to the 21 week moving average would be in line with the previous pullbacks we have seen earlier this year,” Citi argues.

In line with this view, Citi added a short GBP/USD position as a trade recommendation in its technical portfolio (10% allocation). The trade entered at 1.7000 with a target of 1.6750 and a stop at 1.71.