As widely expected, the Fed made its fifth USD 10bn cut in its QE programme, to USD 35bn a month, again equally split between Treasuries and MBS. We still expect QE to end in Q4 2014.

Fed indicated that a rate hike is still not imminent, reaffirming its plan to keep the fed funds rate low “for a considerable time” after the end of QE, which we still see in Q4 2014.

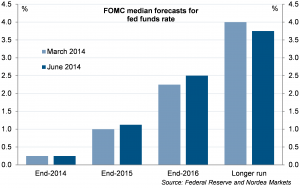

Still the “dots” showing the FOMC participants’ expectations of the fed funds rate drifted up a little for the next few years, indicating a slightly faster pace of tightening during 2016 than earlier indicated. Thus, the median FOMC projection for the fed funds rate was unchanged 0.25% by end-2014, but it was lifted a touch from 1.00% to 1.125% by end-2015 and from 2.25% to 2.50% by end-2016. However, this change has balanced by a downward revision of the “longer run” median forecast, which is seen at the Fed’s estimate of the neutral/normal level, from 4% to 3.75% (see chart below).

Although Fed chairman Janet Yellen has gone out of her way to play down the significance of the Fed’s interest rate projections, we believe the dot plot will remain very important for the markets’ interpretation of the Fed’s rate intentions, especially in light of the central bank’s recent move from quantitative to qualitative guidance.

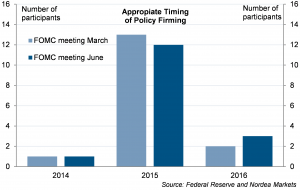

Out of the 16 participants at today’s meeting, 12 expected that it will make sense to start raising rates in 2015 (see chart). In March, 13 participants saw the first rate in 2013.

Given the 1.13% median FOMC projection for the fed funds rate by end-2015 and an assumed modest 25bp of tightening per FOMC meeting, this would place the first rate hike in Q3 next year, roughly unchanged from the March projections. Ahead of today’s FOMC meeting futures markets were pricing in the first rate hike (of 25bp) in around June 2015. At the time of writing, it is still the case. We still expect the first Fed rate hike in Q1 2015, probably in March.

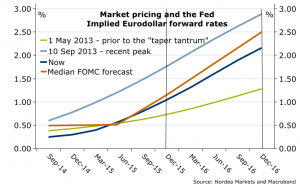

Markets are still pricing in less tightening than implied by the 2.50% median FOMC forecast for the end of 2016, although not to the same degree they were a few weeks ago. Thus, currently the December 2016 Eurodollar futures contract prices in an implied fed funds rate of 2.16%, up from 1.84% in late May (see chart). 11 out of the 16 FOMC participants at today’s meeting expect a fed funds rate of 2.25% or higher by end-2016.

In our view, the Fed’s current guidance is simply unsustainable if the economy evolves in line with the Fed’s projections. Thus, adjusting for the additional stimulus of the Fed’s balance sheet, the 2.50% median FOMC forecast for the fed funds rate by end-2016 is equivalent to a near 0% interest rate policy – at full employment!

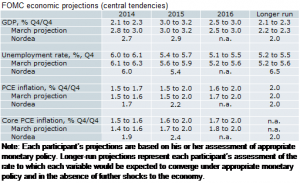

Unsurprisingly, the FOMC lowered its projections for real GDP growth in 2014, to 2.1- 2.3% Q4/Q4, down from the 2.8-3.0% projection in March (see table). Our forecast is 2.7%. At the same time, officials reduced their projections for the unemployment rate at end-2014 to 6.0- 6.1%, from 6.1-6.3%. Our forecast is 6.0%. Finally, the core inflation projection for 2014 is now 1.5-1.6%, only marginally up from 1.4-1.6%. Our forecast is 1.8%.

Nordea