There has been little divergence from the dominating theme of low FX volatility in this benign market environment. Easter holidays across many trading centres have also contributed to relatively low volumes, while further dovish commentary from FOMC Chair Yellen checked the USD’s recent modest recovery.

With momentum building behind the US industrial cycle, tentative signs of wage-based pressure building, and further labour market improvements likely, falling US rates are unlikely to continue to be a major driver of USD weakness. However, with few catalysts on the horizon, we see little to drive FX volatility higher in the very near term either, so demand for carry (funded in USD) is likely to persist.

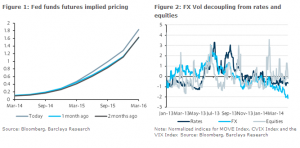

FX volatility has decoupled from volatility in rates and equities markets. One explanation could be that movements in rates have been fairly correlated, so despite reasonably large moves in rates markets, rate differentials have not moved dramatically; hence, currencies have largely stayed in their ranges. Indeed, across most major currencies, according to our short-term drivers model (a factor model that analyses moves in FX relative to equities, rates and commodities), the betas of FX returns to rate differentials across most parts of the curve are at the lower end of their ranges.”

Barclays