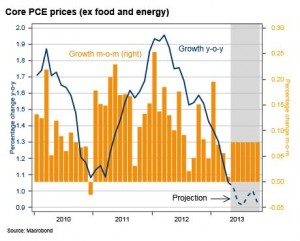

• Core PCE inflation remained at 1.1 percent in April

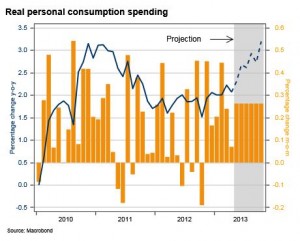

• Real disposable income up 0.1 percent, versus 0.3 percent in March

• The savings rate remained at 2.5 percent in April

Core PCE prices unchanged in April, lower than expected

Core PCE prices were unchanged in April, versus an increase m-o-m of 0.1 percent (revised from an unchanged reading) in March. This was lower than expectations of an increase of 0.1 percent. Headline PCE prices declined by 0.3 percent in April, versus a decline of 0.1 percent in March. This was lower than expectations of a decline of 0.2 percent. Moreover, personal consumption expenditure in constant prices rose by 0.1 percent in April, versus 0.2 percent March. This was slightly weaker than expected. The savings rate remained at 2.5 percent of disposable income in April. Finally, disposable income in constant prices rose by 0.1 percent in April versus 0.3 percent in March.

Consumption to grow at a moderate pace ahead

Worse-than-expected incoming data recently have likely weighed on consumer sentiment. Moreover, it was likely also affected by a fiscal headwind: household taxes were raised in January and entitlement payments were reduced from March. However, a sharp recovery in the housing market and increasing employment are mitigating the fiscal headwinds. We expect household spending to increase at a moderate pace ahead. Households tend to smooth spending in the short term. The tax increase in January permanently lowering disposable income, but this did not fully spill over to lower spending. Instead, savings declined. However, in a longer perspective, households will likely lower spending correspondingly as they adjust to the new lower level of income.

Projections of core inflation and real consumption

In the following charts, we make projections under the assumption that core PCE prices and real consumption will change ahead at the same pace as their averages over the past six months.

Handelsbanken