GBPUSD reversed off a critical area as we see whether 1.5200 resistance holds. Tactically, the reversal is disappointing for those looking for a squeeze higher, but the situation remains in limbo.

The USD is all over the place today – up against the Euro and and very slightly against the franc, but down against virtually everything else. Against the pound today, it’s been both down, but also a little bit up, too. The strong UK Retail Sales data at first pushed GBPUSD higher, and bulls/short-squeezers were looking at the 1.5200 neck-line area of the upside down head and shoulders formation with great interest. But the rally faltered and the short term disappointment has driven the pair back into the recent range.

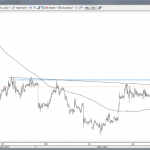

Chart: GBPUSD hourly

It’s a tactical reversal setup (also see below) for bears here locally today with a clear risk reward (perhaps 1.5195 for stops), but the weak USD elsewhere has to be a worry. Still, bulls need a move and hourly close back above 1.5200 to get upside traction and then on to projection targets starting with 1.5370. Tomorrow will be decisive if today closes quietly from here.

Chart: GBPUSD daily

Note that today’s high was fairly close to the 0.382 Fibo retracement of the recent wave. A close below 1.5110 or so would offer a more clear bearish reversal indicator in terms of candlestick patterns – current price at the close doesn’t damage the bullish case much in this perspective.

SAXO BANK